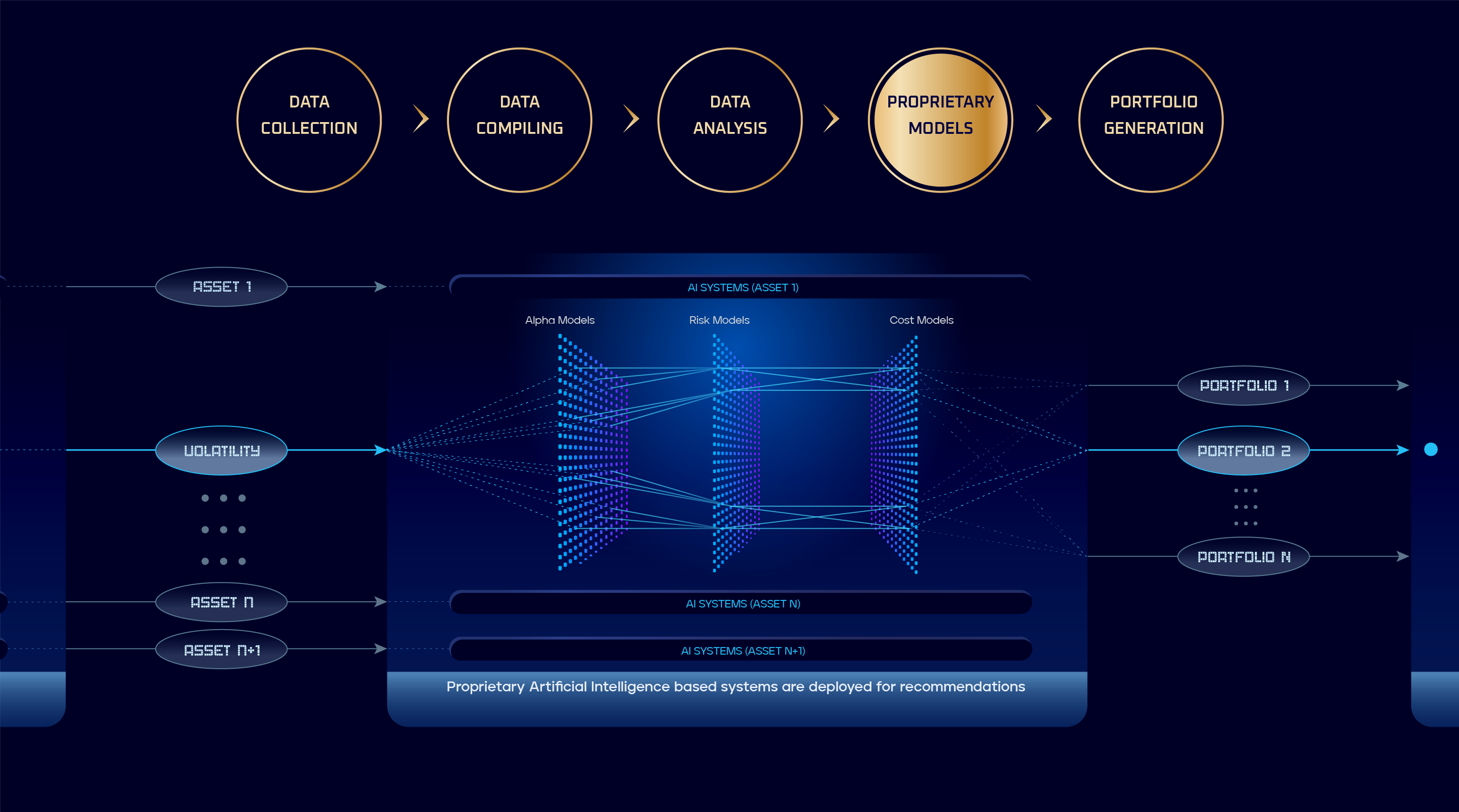

4 IMPLEMENT

the most robust model

in real-time.

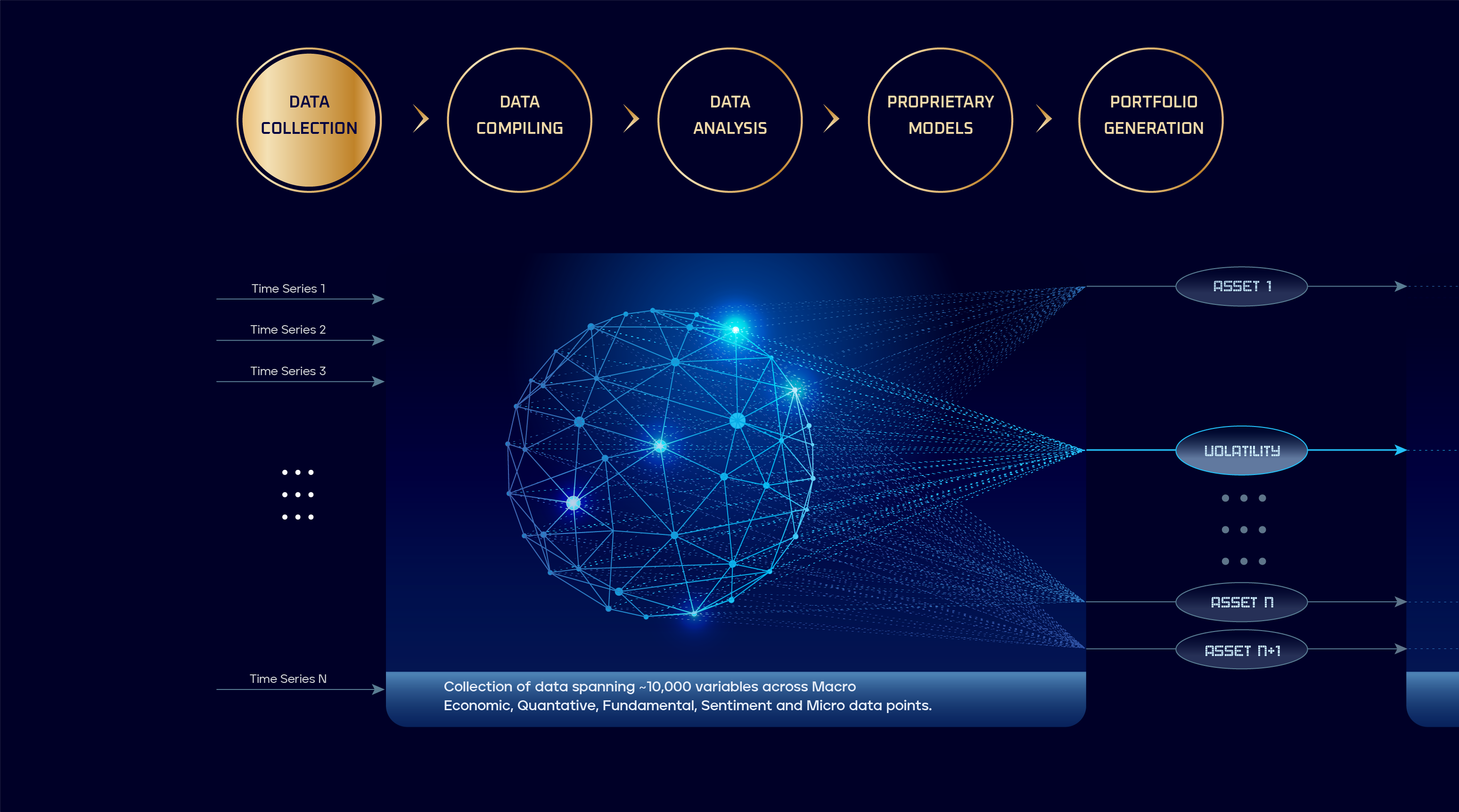

1 TRACK

Global macro,

Fundamentals, Quants and

Sentimental data points.

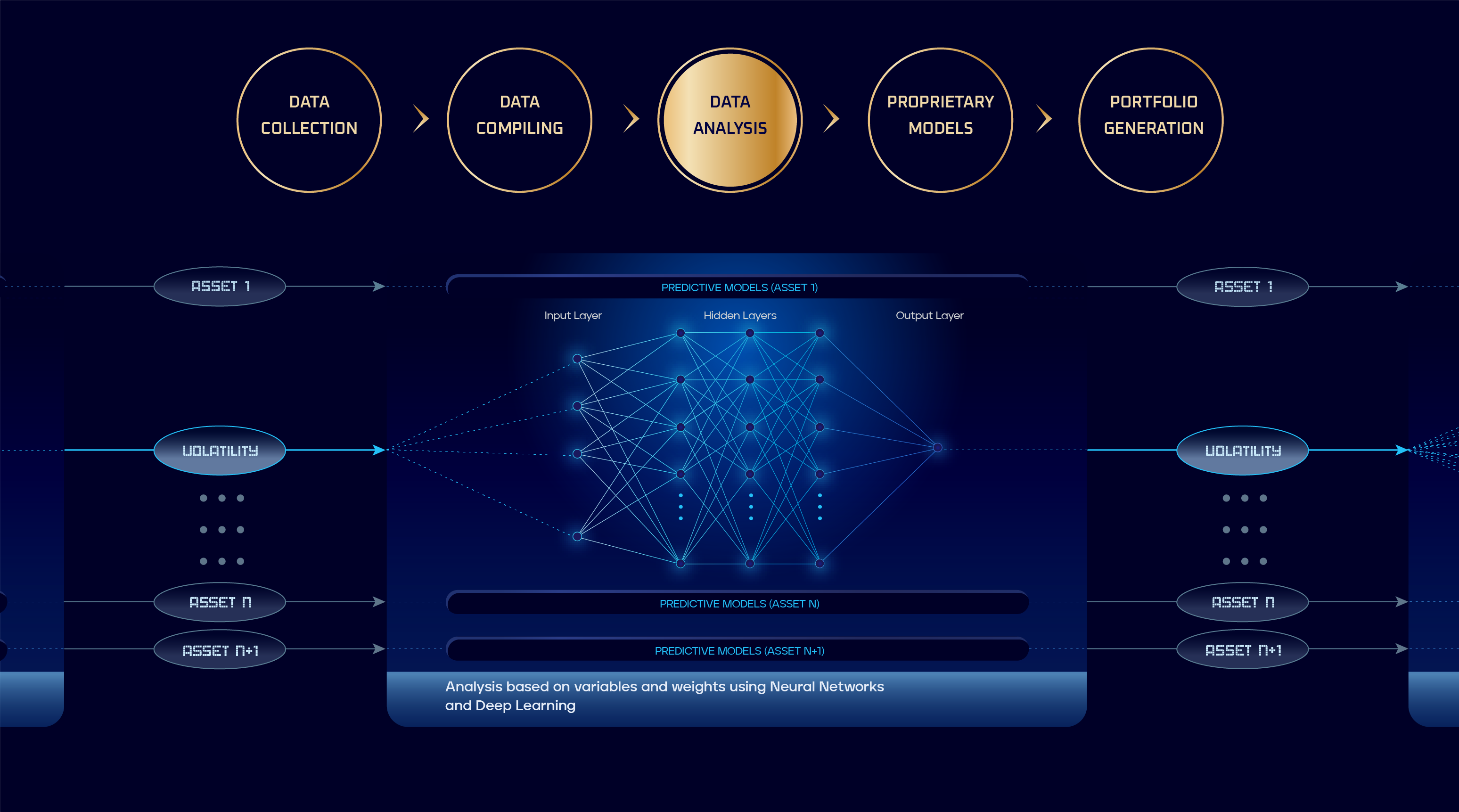

2 UNCOVER

hidden patterns based on

historical data vis-a-vis

traditional research.

3 ALLOCATE

portfolio by training systems

with past data and keep it

sector and industry-agnostic.

5 BUILD

mathematical and deep machine

learning-based predictive investment

models by analyzing parameters through

technological advancements.

6 DEVELOP

strategies based on capital,

risk appetite, timeline, and

return expectation.

7 TEST

models against large datasets

to correct any anomalies from

desired outcomes.